Are Tax Lotteries Regressive? Income, Consumption and, Occupational Characteristics of Winners

Abstract

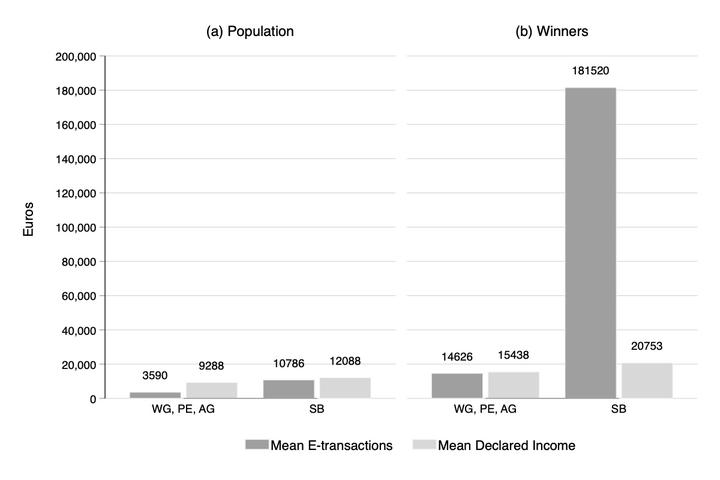

Tax lotteries can increase tax compliance by providing incentives to consumers to ask for a receipt. Whilst their effectiveness has been studied in economic literature, less is known about their progressivity. Using administrative data from the Greek tax lottery, I analyse the income, consumption and occupational characteristics of winners and I document that high income individuals win more frequently. A 10% increase in taxpayer [spousal] income is associated with a 0.11% [0.6%] increase in the winning probability. Self-employed or business owners record particularly large amounts of transactions and receive a large number of lottery tickets, which indicates either under-reporting of income or the channeling business expenditure through personal bank accounts. They exhibit 18% higher winning probability than other occupational categories. Using Monte Carlo simulations, I explore reforms for tax lottery design and I find that a monthly ticket ceiling per individual improves prize allocation and progressivity. Additional results with economic significance are (i) imperfect income sharing within household (ii) a marginal propensity to consume at 0.18.