Winning the Tax Lottery: Evidence from a Superdraw on Christmas Eve

Abstract

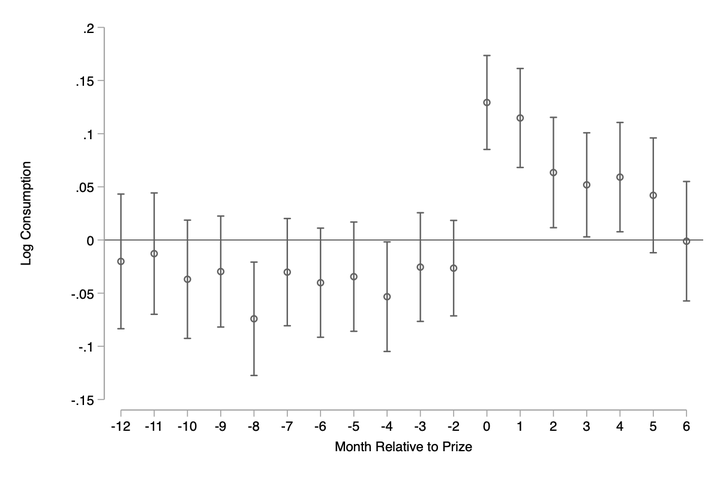

This paper studies a tax lottery in Greece and documents an increase in VAT revenue. The lottery incentivises the use of electronic payments over cash to fight tax evasion by allocating EUR 1 million in prizes every month. Tickets are awarded automatically when individuals complete retail transactions by electronic means. I exploit a superdraw at the start of the lottery in Christmas Eve 2017; participation was unanticipated and individuals could not influence their winning chances. I estimate that regional VAT revenue increased by 0.01% per additional winner (or by EUR 2,700 compared to a EUR 1,000 winning prize). This effect can be explained through winners, who increased their electronic consumption by 14%. Lasting for five months, this channel alone cannot explain the entire VAT effect. A second channel is documented through spillover effects from winners to non-winners. The lottery’s positive outcome demonstrates the potential of electronic payments to raise tax revenue.